Has Trump Cowed China?

It was not long ago that China loomed large on the horizon. Their fast-growing economy and seemingly limitless human resources meant China could build up its military and slowly buy up US debt instruments. The trade imbalance continued to grow as China used every trick in the book to rob the US economy of capital. How long would it be before China would have a large enough portion of that debt to control interest rates? Would China have sway over US fiscal policy? China has also been making aggressive military moves in the South China Sea a critical transit route for a global trade. Yet, thanks to President Trump, not only is China going to have to invest in balancing the trade deficit and play fair in trade relations, China will also be brought to heel in military matters.

Recent Updates

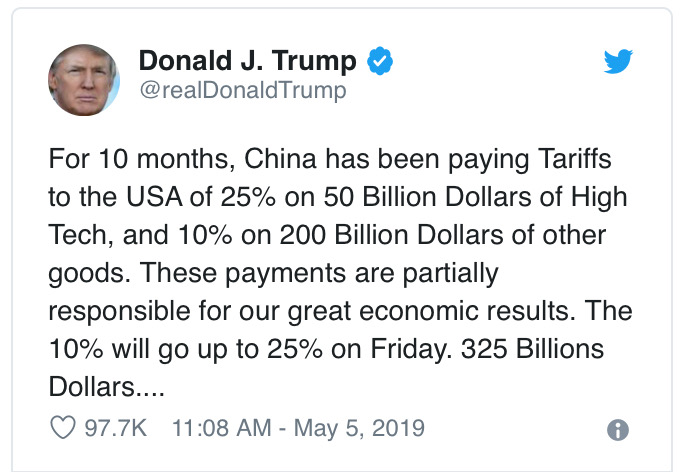

President Trump recently tweeted a threat to increase tariffs on some Chinese imports to the US. Obviously, these are incentives to encourage the Chinese to sign the trade deal sooner than later, which would lower these tariffs.

The China Trade Deal

The China trade deal is coming together and may be signed in the next few months. The details have been discussed in a previous article. Since the publication of that article, China has removed its high tariffs from US oil imports, a huge change with major implications for the US economy. US oil exports are already strengthening the American economy, increased oil exports to China will mean still more jobs and opportunities in the United States. President Trump and his negotiators have arranged in the trade deal for China to spend $1.2 trillion over six years buying US goods, mostly on agricultural equipment, helping to balance the existing trade deficit and leading to a fairer balance of trade. The impact on the US economy will be enormous. As negotiations approach their climax, President Trump has raised the stakes by calling for the Chinese to double the $1.2 trillion figure.

That the Chinese are even willing to consider such a trade deal demonstrates the current weakness of the Chinese position. Why are they discussing fairer trade with the US when they have been getting away with robbing us blind for decades? The Chinese economy must be more fragile than is commonly known. While many analysts try to claim that the trade war with China hurts the US more than China, clearly this is not the case. In fact, access to the largest and most affluent consumer base in the world is a precious commodity, and Trump is leveraging that to address China’s unfair trade practices. There are also strategic and military consequences for this trade deal.

The trade imbalance has drawn capital away from US manufacturers to their Chinese counterparts. The theft of intellectual property has allowed Chinese companies to create cheap knock offs of everything from cameras to software that are protected by patent and intellectual property laws in the US. China has manipulated the value of its currency to be the most advantageous, rather than allowing the market to set the value. Heavy government subsidies for raw materials allow Chinese companies to undersell US goods.

President Trump ran for President on a policy of placing America first: he opposes unfair trade situations. The President’s strategy in several negotiations has been to create some leverage to demonstrate the strength of his position. He then works to negotiate a fairer deal from that position of strength. When President Trump raised tariffs on South Korean steel imports, the Koreans quickly calculated the cost to their economy if these increased tariffs remained in effect. They negotiated with the President and he agreed to eliminate the increased steel tariffs if the Koreans lowered tariffs on US automobile exports to Korea. The result was a good deal for both parties and more balanced trade betwixt them. Moreover, working class Americans in the Rust Belt who are “hurt” by Korean steel imports were “helped” by increased automobile exports, not only are automobiles assembled in Detroit, a large number of auto components are also manufactured in the region.

President Trump began with China, as he did with several countries, by raising tariffs on Chinese imports; China chose to wage a trade war. Several US industries have been “hurt.” Many analysts are eager to play up this pain in order to portray the Trump administration in a negative light. In fact, the entire US economy has been injured over the years by the anti-competitive practices of the Chinese government. Some analysts suggest the pain has been much greater for the US than for China. If one looks at published economic data, perhaps one could be led to this false conclusion. China regularly manipulates their economic data to exaggerate to whatever extent it can, its own prosperity. If China is being hurt less than the US, why are the Chinese willing to negotiate a trade deal that will be so costly? Perhaps they know something American analysts are ignoring. Is there evidence of economic trouble in China? This year’s National Congress session began with a warning of economic slowdown. To remedy the situation Premier Li Keqiang introduced a number of measures including tax cuts, extensive local government borrowing for infrastructure projects, and a massive job retraining program. If anyone believes China is sailing smooth economic waters they need to ask themselves why the Chinese Communist Party is embracing tax cuts… This information is readily available to those whose objectivity has not been corrupted.

The Security Situation

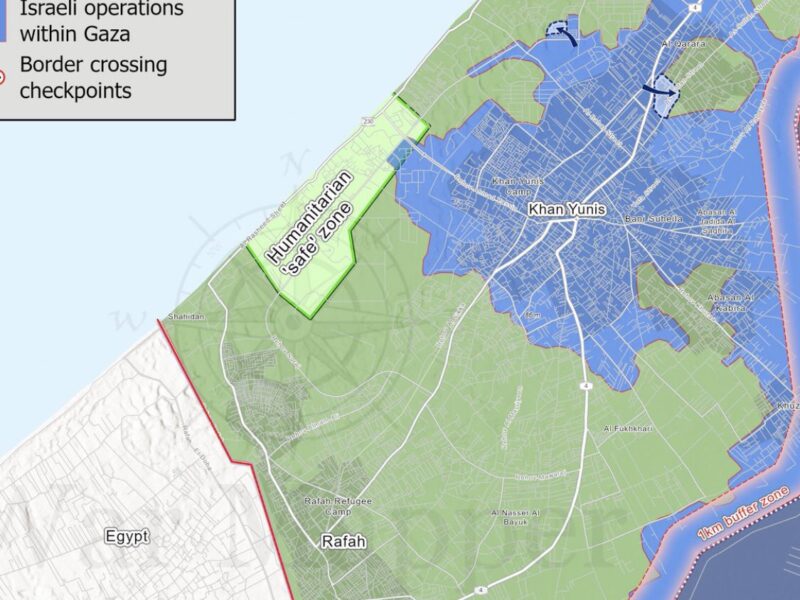

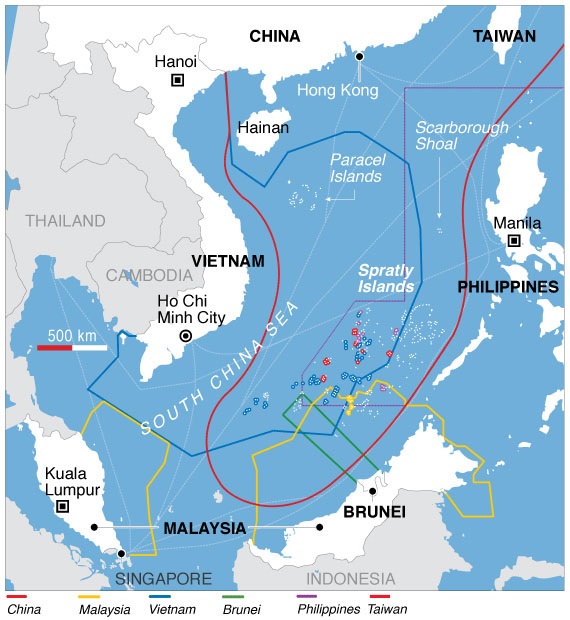

The United States has been to war more frequently to protect the free navigation of the seas than for any other cause. It was a major concern in both World Wars, for example. Trade across the open seas has helped America prosper and has brought prosperity to much of the world. China is threatening that free navigation, and thus that prosperity, by trying to control navigation in the South China Sea, a sea through which $5 trillion of global trade passes annually. China has built several artificial islands and their warships regularly threaten to ram ships, military and civilian, in an effort to control navigation. The US supports free navigation of international waters.

China has built up its military in recent decades. China has not backed down on its desire to occupy Taiwan. China has protected North Korea’s oppressive regime. If the United States is not pleased by China’s trade policies, it is all the more put off by Chinese aggression in the South China Sea. Could the two matters be related? Could Chinese malfeasance in trade practices and an aggressive foreign policy be linked? They certainly can, and they can be addressed together by the United States as a single economic matter.

Prior to Trump’s election China was riding high. The United States more than doubled its national debt during the Obama Administration, weakening America’s fiscal strength. As a major buyer of US debt, China was very near a state where they could dictate the interest rates they demand in order to be willing to buy that debt. The ability to increase the cost of US debt service at any time, possibly by hundreds of billions of dollars, would be a serious threat to American security. China would have a powerful influence over US social spending and defense spending. This danger still looms on the horizon, but President Trump’s election and the resulting economic boom have pushed that prospect many years down the road.

President Trump’s China Gambit

By increasing tariffs on China and through his willingness to tough out a trade war, President Trump forced China to the negotiating table. The President is using access to the US markets as leverage to force China into a more balanced trade policy. This also strengthens America’s hand in security matters. The Chinese economy is frail and their leaders feel the weakness. There are other signs of weakness and political instability in China: several political personalities have been disappeared, China has cracked down on freedom of expression, and President Xi Jinping has bolstered his own political power. China is not as strong and stable as it appears from the outside. China desperately needs its trade relationship with the US to prop up their decaying system. China needs the US consumer market, they need its exports to survive.

In short, President Trump seems to be taking a long view and is carefully maneuvering the United States into a position of strength. When the deal is signed, Chinese tariffs on many US goods will be lowered or eliminated. The end of the trade war will revive those industries hurt by Chinese economic reprisals. The trillion plus dollars of investment in the US economy will create many jobs and opportunities. It might take a year to feel the full effect of these economic blessings, but they will be felt next summer especially in the Rust Belt–just in time for Americans to go to the polls and consider whether President Trump deserves a second term of office…