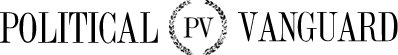

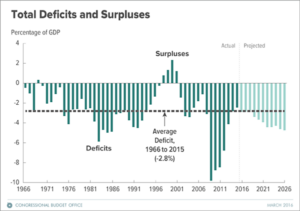

It’s The Spending – Politicians and Deficits

What causes deficits?

Well, the answer, of course, is not what, but who. They are caused by those that spend.

In your own life, if you have debt, it is likely because you spent beyond your means. When it comes to governments, spending beyond their means is the historical norm.

When you look at that chart, is it your sense we didn’t pay enough in taxes (despite record taxes being paid) or that those who ran our governments spent too much?

That is why it is ironic – or cynical – that some politicians are concerned that the proposed tax cuts/reform will lead to higher deficits.

Putting aside for the moment that a correctly crafted tax reform would lead to an expanding economy and higher revenues (see the 1920s, 1960s, 1980s and the years following 2003 – 2005), what our politicians should be concerned about is why government spending is now roughly 300% higher than when President Reagan said “government is not the solution tour problems, government is the problem.”

Governments bankrupt nations not those who work to pay the endless array of taxes, the combination of which, i.e spending and taxes, that in time sap and economy and grind it to a halt. You know, like the European Union, which has seen 0% growth for the last 20 years or the U.S. which has seen growth of less than 2% as measured by the same government that is grinding it to a halt.

Today, my Forbes’s colleague, John Tamny says in plain terms, that which the elites of Washington D.C. and beyond cannot understand, but which everyday Americans can:

Today, all government spending in the U.S. exceeds 37% of the economy. The costs of federal regulations, at least prior to the current round of deregulation, was close to two trillion dollars. While some regulations are important, overall the combination of those regulations, state regulations and total government spending means that over half the U.S. economy is either government spending or the costs to respond to their edicts.

Cleary, that means our governments have greater control over the economy. Given the decline in growth over time that “control, AS A RULE, weakens it.

So what is the answer?

As John Tamny notes: “We can crash the economy, which will halt federal borrowing. Or we can massively shrink federal spending.”

Which do you think we should pick?

Read John Tamny’s full article here:

Andrew Ross Sorkin & Sen. Jeff Flake Misread the Cause of Irrelevant Budget Deficits