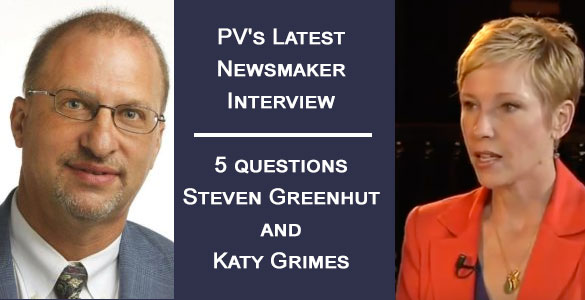

5 questions for Steven Greenhut and Katy Grimes on What Lies Ahead for California in 2018

PV’s Exclusive New Year’s Newsmaker Interview:

Steven Greenhut and Katy Grimes

on What Lies Ahead for California in 2018

The New Year is here and Politicalvanguard.com Publisher Tom Del Beccaro sat down with Katy Grimes and Steven Greenhut to get their thoughts and predictions on California and 2018.

The New Year is here and Politicalvanguard.com Publisher Tom Del Beccaro sat down with Katy Grimes and Steven Greenhut to get their thoughts and predictions on California and 2018.

Thank you both for giving PV readers your thoughts and predictions for 2018.

Question No. 1. Let’s start with the new marijuana law. At the end of 2018, what will Californians experience as a result of the legalization of pot? Will crime increase? How will this impact California’s jails?

Steven Greenhut: I don’t think all that much will change. Pot has been de facto legalized in this state since 1996. Since then, its use has been growing in the state and much of the stigma dropped. I don’t believe there is a necessary correlation between legalization and increased use. So, to me, it will be a non-issue except that government now will be collecting taxes.

Tom Del Beccaro: And the effect on crime?

Steven Greenhut: Again, I don’t think it will amount to much. If anything, it may drop because it is now legal.

Tom Del Beccaro: Katy, I know you have a different view. You have an article in PV entitled: Pot is a dangerous “Recreation.” Why do you write that?

Katy Grimes: I can’t agree with Steve on this issue. As I cover at length in the article above, I anticipate an increase in crime and DUI arrests, as Colorado and Washington State have seen since legalization. I’m also extremely concerned with an increase in young people using – again, exactly as Colorado and Washington have experienced. And California has 38 million residents, so it will be on a much larger scale.

Tom Del Beccaro: I tend to agree with Katy on this issue. In a place this big, the opportunity for abuse and crime is far greater than Colorado and Washington. I don’t think California really knows what to expect. I think voters will rue the day they agreed to this law.

Question No. 2. It’s an election year. So, the question must be asked: Given Prop 14, the Top 2 primary system, will there be a Republican on the November ballot for any statewide office? Katy, let’s start with you.

Katy Grimes: There will not be a Republican on the Fall ballot for either Governor or the U.S. Senate –California’s swamp has seen to that, including prominent Republicans. We can thank those proponents of Proposition 14, the Top Two Primary, for largely killing the possibility of fair or balanced elections in California and not allowing voters any real choices. I was vehemently opposed to Proposition 14 and appalled that any Republicans supported it or still support.

Steven Greenhut: I agree with Katy. I don’t think Prop 14 changes the final result in the major races – Democrats at this point have an unfortunate lock on statewide races. But Prop 14 will result in no Republican making it to the Fall ballot for Governor or U.S. Senate. I too opposed Prop 14 when it was on the ballot for that and other reasons. It stifles debate across the state. Its repeal would be good for California.

Question No. 3. What ballot measure should be on voters’ mind in 2018?

Steven Greenhut: In my view, Prop 13 should be at the top of the list. Two measures will likely make it to the ballot on that issue. One good, one very bad.

Once again, voters will be asked to take away Prop 13 protection for commercial property. Right now, it protects commercial and residential property and the public employee unions and the legislators they control would like to take the commercial property protection away. That would amount to an $11 billion tax hike – that will be passed on to renters and eventually consumers.

I am interested to see whether the changing demographic of voters and also the drop in homeownership rates will result in a victory for the unions this time around.

On the other side, an initiative that would increase “portability rights” – your ability to move to other counties and preserve your lower tax base – should make the ballot. I like that idea and that the forces for tax protection are on the offensive on this issue. Playing defense all the time is a losing strategy in the long run.

Katy Grimes: I agree those union cases are very important. In addition to that, we are already seeing measures to repeal the gas tax increase – one to repeal the law, and one is a Constitutional Amendment to require all future gas tax increase are passed by the voters by a two-thirds majority, as is the case with Proposition 13.

What I’d really like to see on the ballot is a Proposition to require the Legislature and all State government to have to abide by the laws they pass – no more exemptions for lawmakers or government agencies or employees.

Question No. 4. Will other taxes be raised by the legislature?

Katy Grimes: At the state level, maybe not because of the resignations of Democrats that have at least temporarily taken away the Democrats 2/3rds majority.

Even so, we can expect every county in the state to have tax increase measures on the ballot. The Legislature passed a bill last year allowing counties to raise taxes with only a majority vote, rather than the Constitutional requirement of two-thirds, required by Proposition 13. The California Supreme Court dubiously struck down the legal challenge to the bill by the Howard Jarvis Taxpayers Association.

Each county needs to find ways to backfill its pension debt problem. Regardless of where the tax revenues are earmarked, they will be diverted to pensions. And it will not be enough.

Steven Greenhut: That seems to be their first response to any fiscal issue, doesn’t it? Of course, that is always a possibility.

I am also focused and concerned about local tax issues at this point as well. I think the Democrat legislature may well lift the sale tax cap and allow local governments to raise sales taxes in an effort to deal with the local pension crises that are affecting governments up and down the state. Look for many tax increase measures this fall at the local level to be on the ballot.

Question No. 5. What will be the California story of the year?

Steven Greenhut: For my money, two court pension cases could be the story of the year in California and the nation. Those cases will be decided this year that could change the issue forever or could keep the status quo, which, in my view, is a recipe for government bankruptcies.

At the federal level, the U.S. Supreme Court Janus case could change everything. That is a case is Friedrichs 2.0. Friedrichs was the forced union dues case that wound up a 4 -4 tie in the Supreme Court due to the death of Justice Scalia. Janus is essentially the same case. Now the Supreme Court essentially will decide if public employees have to pay union dues or whether unions have ask public employees to join before dues have to be paid.

We know that, in Wisconsin, when union members had an open choice, union membership, union dues and therefore union power dropped considerably. If that occurs nationally, it will have a dramatic impact across the nation and in California.

Here at home, the state Supreme Court could decide that the “California Rule” could be paired back and maybe even undone altogether. Currently, the “California Rule” says that if a pension right has been granted to workers, it cannot be reduced in the future in any way. Well, that is a recipe for bankruptcy in this state because the unfunded liabilities for retirement and medical benefits far exceed the state and local government’s ability to pay what has been promised.

Katy Grimes: I agree with Steven about the Janus Case, and cannot add anything he didn’t already address.

Jerry Brown’s lawyers filed a brief defending his 2013 pension reform – and the language in his brief goes beyond just defending the new law and seems to support paring back the California Rule. The unions see this as an existential fight. They want no reductions whatsoever. If they win, it is bad for California. If Brown wins, it could be a significant step that allows changes for current workers going forward – and breaks out the current situation where cities have no choice but to raise taxes and cut services.

Bonus Question: Yes or no . . .

Will the Republican tax bill, which reduced the ability of California residents to deduction state and local taxes, deter the California Democrats from passing a huge healthcare bill and the taxes they want to pay for it?

Katy Grimes: No. California Democrats are drunk with power. When they achieved a legislative supermajority, they declared their war against President Donald Trump, and their resolve in passing every item on their agenda. They have shown they have no regard for economic issues or how to pay for massive programs; High Speed Rail and the Delta Tunnels project are evidence of this. Democrats already tried to pass single-payer health care earlier this year, and were livid when Assembly Speaker Anthony Rendon pulled the two-year bill, until they could revisit it in 2018… all in good time. It was a brilliant rouse.

Steven Greenhut: It would be great if the GOP tax plan, which is a very solid plan as it is, put the kibosh on Democratic plans to impose a single-payer health system in California. If state taxes aren’t deductible, then California can’t force other states to help pay for its insane public policy. The State Senate Appropriations committee report found that the plan could be larger than the entire state budget. Single payer would destroy health care here. Even the rich would have to seriously consider leaving.

Connect with Katy Grimes at the sites below.

Facebook Twitter. Katy’s Politicalvanguard.com page

Connect with Steven Greenhut at the sites below.